Airline Mergers Reshape 2025 Travel: Routes, Fares, and Competition

Airline mergers are reshaping the skies in 2025, from mega deals in the U.S. and Europe to Air India’s big rebrand. Here’s what it means for travelers.

Introduction

Welcome to Keeping Up with the Airlines - your go-to spot where I break down the latest buzz in aviation. Whether it’s fleet updates, new routes, or the corporate chess moves happening behind the scenes, this is where we unpack the stories shaping the way we fly.

And today, I’ve got one of the hottest trends of 2025 for you: airline mergers.

Now, if you’re an aviation geek, you already know mergers aren’t exactly new. Airlines have been teaming up, buying each other out, and stitching together alliances for decades. But this year feels different. The pace is faster, the deals are bigger, and the timing couldn’t be more crucial. From Air Lease’s $7.4 billion acquisition, to Lufthansa finally sealing its long-anticipated 41% stake in ITA Airways, to Republic Airways and Mesa Air Group shaking hands on a regional mega-merger in the U.S., the industry is going through a major reshuffle.

So, why does this matter? Because airline mergers don’t just happen in boardrooms. They decide which routes stay alive, how much we pay for tickets, which airports become crowded battlegrounds, and even which airlines dominate entire regions.

That’s why in this blog, we’ll dive into what these airline mergers mean in 2025: why they’re happening, the biggest deals you need to know about, how regulators are reacting, and most importantly, how all this affects the future of airline competition. Buckle up - we’ve got a lot of airspace to cover.

What Are Airline Mergers and Why Do They Happen?

Alright, let’s start with the basics. An airline merger is exactly what it sounds like: when two (or more) airlines decide to join forces and become one bigger airline. Sometimes it’s a straight-up merger (two companies blending into a single brand), other times it’s an acquisition (one airline or aviation company buys another but keeps its identity or folds it into its own).

Why do airlines do this? Well, it’s rarely about “friendship in the skies.” It almost always comes down to money, market share, and survival. Here are the main drivers:

✈Cutting Costs:

Running an airline is expensive - fuel, labor, aircraft maintenance, airport fees, you name it. By merging, airlines can pool resources, share staff, reduce overlapping routes, and cut back-office costs. In short: spend less, earn more.

✈Expanding Routes & Networks:

If Airline A flies everywhere in Europe and Airline B dominates Asia, together they can suddenly offer passengers more destinations without starting from scratch. It’s a fast track to building a global network.

✈ Beating Rivals:

Competition in aviation is brutal. Bigger players often swallow smaller ones to stay ahead. By merging, airlines can strengthen their market position, capture more passengers, and make it harder for rivals to undercut them.

✈Access to Financing (and Leasing):

Buying planes is insanely capital-intensive. With leasing giants like Air Lease Corporation now consolidating, access to cheaper aircraft financing becomes even more crucial. Airlines often merge to look financially stronger on paper — which makes lenders and lessors more willing to back them.

✈ Weathering Crises:

Whether it’s fuel price spikes, a global pandemic, or regional economic shocks, airlines know turbulence is inevitable. A bigger airline has more buffers - more routes, more aircraft, more passengers - to spread the risk.

So, while airline mergers might sound like glamorous boardroom deals, they’re really survival strategies in one of the toughest industries on earth. They’re about staying afloat, staying competitive, and sometimes, just staying alive.

Recent Major Airline Mergers Around the World

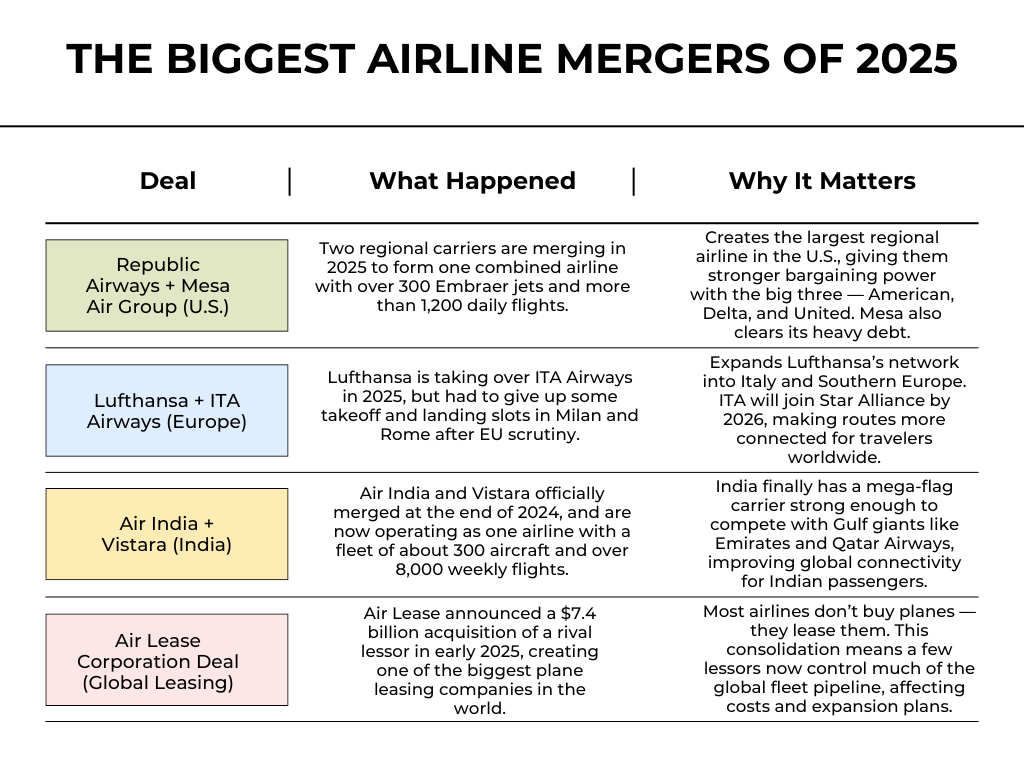

Republic Airways + Mesa Air Group: “The Regional Avengers Unite”

When Republic Airways and Mesa Air Group decided to merge, it wasn’t just a handshake deal — it was a makeover on a grand scale.

- Who's in charge? Republic’s team takes the wheel, holding about 88% ownership of the new airline. Mesa gets a fair slice too - 6% to 12%, depending on how well they hit their pre-closing goals.

- Bigger fleet, more flights: United, Mesa, and Republic are merging their Embraer jets into one mega-fleet of around 310 planes, cranking out more than 1,250 flights a day.

- Mesa’s debts? Poof - gone. This merger cleans the slate.

- The new airline keeps flying for the big names: The new airline isn’t changing its day job - Republic will keep operating flights for American, Delta, and United. On top of that, Mesa scored a shiny 10-year capacity purchase agreement with United, locking in steady business for the future.

Lufthansa + ITA Airways: “Italy In, Sky Wars Out”

Over in Europe, Lufthansa finally made its long-awaited move: on January 17, 2025, it bought a 41% stake in ITA Airways for about €325 million ($350 million), with big plans to take full control by 2033 after pumping in a total of €829 million.

But this wasn’t a “no-strings-attached” romance. The EU made Lufthansa give up valuable takeoff and landing slots at Milan and Rome so rivals like EasyJet, IAG (British Airways & Iberia), and Air France-KLM could still compete.

And here’s the big shakeup: ITA ditched SkyTeam (where it used to hang with Delta, Air France, and KLM) and is gearing up to join Star Alliance in early 2026 — basically moving into Lufthansa’s squad. This gives Star Alliance a stronger grip on southern Europe.

So, to sum it up: Lufthansa didn’t just buy into ITA - it bought itself a stronger presence in Italy, a future monopoly in the making (with EU guardrails), and a shiny new ally for its Star Alliance empire.

Air India + Vistara: “India’s National Flag Gets a Makeover”

After months of “will they, won’t they,” Air India and Vistara finally tied the knot on November 12, 2024. The Tata Group decided it was time to create one mega full-service airline, all under the Air India name (Air India, TOI).

And oh boy, the scale is not small talk. We’re talking 300 aircraft, 312 routes, and more than 8,300 weekly flights . The full-service Air India alone is flying 120,000+ passengers daily, while Air India Express is still around for your budget adventures with another 2,700 flights weekly. Basically: they’ve gone from “it’s complicated” to “catch us if you can.”

For passengers, this means less chaos, more chill. No more double-brand confusion - everything is Air India now. Plus, with Star Alliance perks, your boarding pass just got a serious glow-up . Say goodbye to juggling apps and flight codes, and hello to smoother bookings and (fingers crossed) fewer last-minute cancellation texts.

And let’s not forget the global muscle: Singapore Airlines is now a proud 25.1% stakeholder in the new Air India . Translation: there’s serious international polish backing your next samosa-and-champagne inflight combo.

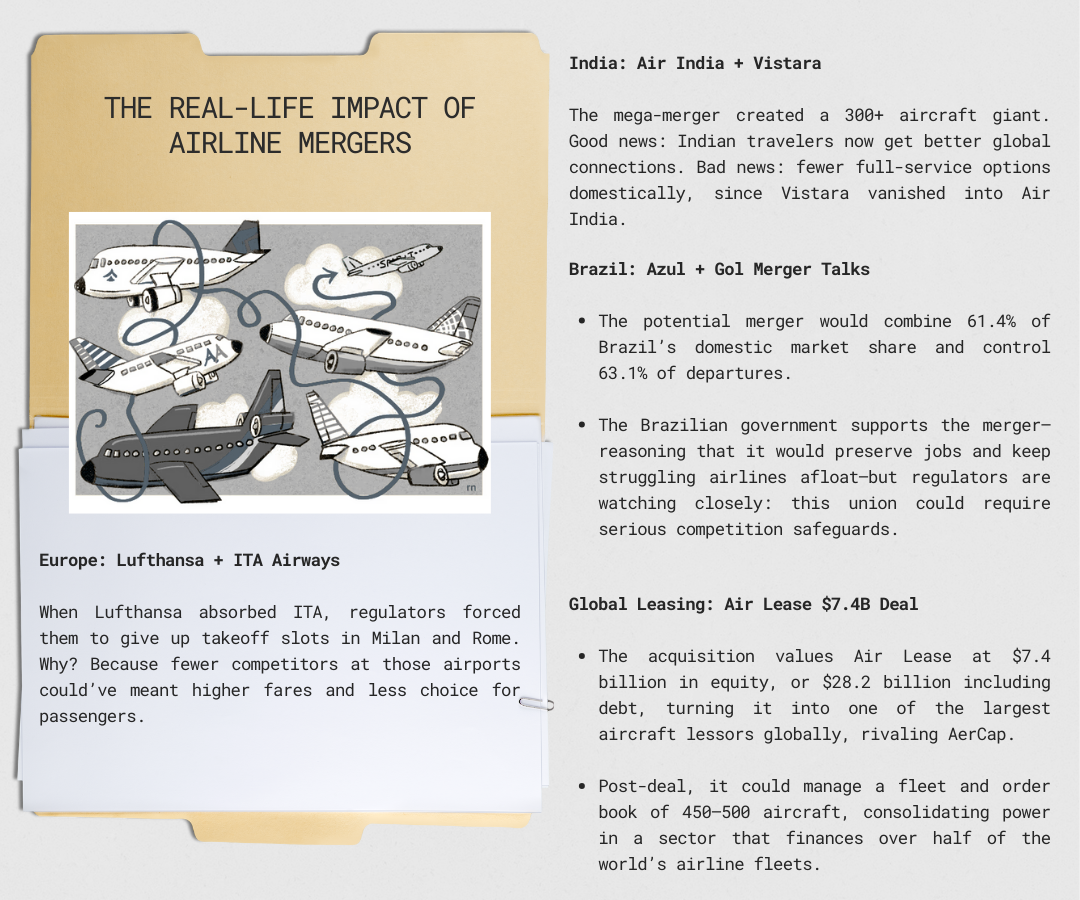

Impact on Market Competition

Airline mergers always come with two sides of the coin: the promise of stronger, more stable carriers… and the fear of fewer choices for travelers. In 2025, with mega deals reshaping aviation from the U.S. to India, competition is already feeling the squeeze.

The Bright Side: What Passengers Actually Get from Airline Mergers

Mergers sound boring, but here’s the truth: sometimes, they actually make flying easier, smoother, and even a little fancier. Let’s break it down.

1. Bigger Networks, Fewer Connections to Juggle

Ready for some good news? The Air India–Vistara merger means one airline can now handle trips from Delhi to Europe or the U.S. under one roof. What that means for you is simple: one big airline that covers more routes, both in India and abroad. Imagine booking Delhi to San Francisco or Mumbai to Frankfurt, and it’s all under one booking reference.

Your bags? Checked through without you babysitting them at some random transfer desk. And those loyalty points you collect? They don’t get split across two different airlines anymore. Also did I mention more routes to choose from ?

2.Financial Stability = Fewer Cancellations

The story of Mesa Airlines is basically a broke college kid with too many loans. Planes were grounded, schedules were messy, and passengers were left wondering: “Will my flight actually take off?”

Then along came Republic Airways, the responsible roommate. In 2025, the two merged, and suddenly Mesa’s mountain of debt disappeared. Together, they now pull in nearly $2 billion in annual revenue, keep over 300 jets flying, and run 1,200 daily flights.

Why does this matter? Simple: airlines without money = chaos for passengers. With Republic’s cash and stability, Mesa can finally pay crews, fuel planes, and keep flights running on time instead of canceling at the last second.

3.Loyalty Perks That Actually Matter

Here’s the tea: ITA Airways is leaving its old gang (SkyTeam) and joining the much cooler one—Star Alliance—by early 2026.

So what does this mean for you? Basically, more perks without paying extra:

- You can book flights on Lufthansa and ITA like they’re one airline-no confusing tickets.

- You’ll get access to 130+ fancy lounges in airports like Frankfurt and Munich (hello free snacks and wine).

- Your miles go further-earn on ITA, spend on United, Singapore Airlines, or any Star Alliance buddy.

The Downside: Where Passengers Lose Out

- Fewer Competitors = Higher Fares - With fewer airlines fighting for passengers, ticket prices often creep up. The U.S. Department of Transportation has warned about this in past mergers (I'm talking about the Delta-Northwest and American-US Airways merger).

- Slot Battles = Less Choice - In Europe, Lufthansa–ITA raised alarms because slots at Milan Linate and Rome Fiumicino are limited. Fewer competitors at these airports could reduce routes and frequency.

- Regional Airlines Get Squeezed - Smaller carriers outside these mega-mergers might find it hard to survive. In India, Go First already collapsed in 2023, and more weak players may follow as Air India-Vistara dominates.

What’s Next for Airline Competition?

Airline mergers aren’t going anywhere. With fuel prices increasing aggressively and airlines pouring billions into “going green,” the safest bet for survival is simple: get bigger or get eaten.

Private equity firms-like the ones behind the massive $7.4 billion Air Lease deal-are already circling, which means we’ll probably see more surprise buyouts and mergers.

For passengers, this could mean fewer last-minute cancellations and smoother connections. But don’t cheer too quickly-less competition often leads to higher fares and fewer quirky budget airlines to choose from.

Small airlines have the toughest choice: stay independent and risk fading away, or join forces with a bigger player and give up some freedom.

Bottom line? The skies of 2025 and beyond are being ruled by fewer, bigger airlines. Great for stability, not so great if you were hoping for dirt-cheap fares.

If you liked this little trip into the world of airline mergers, stick around-I’ll be back with more fun takes on aviation news. Don’t forget to subscribe to our blog so you never miss the next boarding call.

Comments ()